The mechanics of trading volatility can become complex and confusing pretty fast. Intertwined mechanisms, that are often non-obvious, play a role and a multitude of available instruments are far from transparent.

This article will lay out the basics as well as dive deep into practical strategy for interested traders, who have always been stumped by these complexities and maybe lost money on VIX Futures ETP (long volatility VXX, UVXY or short volatility XIV, SVXY and others) – in one direction or the other.

The nitty-gritty details of strategy implementation after the general overview may contain some nuggets even for sophisticated volatility traders.

As I think, that the rewards for trading volatility lay mainly on the short side, I will concentrate on the universe of direct short volatility strategies (based on VIX Futures) in this post. The second major possibility to short volatility are a plethora of option selling strategies (a great way to diversify across many assets to generate a reliable return stream) and many investment styles are implicitly short volatility (long equity exposure, risk parity strategies and many more) with investors bearing similar risks – often unknowingly.

Precisely because so much short volatility risk is hiding in investor portfolios, I think knowledge about its intricacies can be very valuable – not only to become risk aware, but also because of the great return potential that is closely intertwined with the inherent risk.

In the last couple of years trading short volatility strategies has accounted for the majority of my profits, even though about 70% of my portfolio is exposed to market beta (the risk premia of different global asset classes) and only 30% to alternative strategies (which include short volatility). On my „About“ page you can compare the actual monthly returns of a tactical ETF portfolio (The Meta Strategy ETF Portfolios), which equals the market beta exposure, to the returns generated by the combination of tactical ETF exposure, hedges and short volatility strategies (Meta Strategy Derivatives Portfolio).

An outperformance occurred despite several tough periods these strategies experienced in the last years (and can be expected to endure frequently in the future) – including the „volmageddon“ of February 2018.

Diving down from the surface level

Often simplistic thinking about trading volatility on the long side leads to unexpected losses, because of the hidden, underlying mechanics or – on a more thoughtful level – short volatility trading frequently works until it doesn’t (blowing up in a spectacular boooom, news of which spreads through the financial media like wildfire).

To even consider using volatility strategies we need to be sure, that there is a strong case for a historical edge, that has a high probability to continue to exist in the future.

I think, that two basic reasons speak for continued high returns of short volatility strategies:

- Trading short volatility is very risky and sophisticated traders demand a high premium for taking on that risk. They have to live with a very negatively skewed return profile (regular small profits interspersed with rare, high losses) as they insure the crash risk inherent in equity markets.

- A majority of market participants is willing to overpay for long volatility positions, because these work as hedges to protect a portfolio that is exposed to the stock market. Many institutional mandates (e.g. guaranteed return products) are forced to buy hedges even if they are quite expensive – ensuring a continuous demand.

This makes a sound case for a persistent, high volatility risk premium, because it is risk as well as behaviour based – both are reasons that are not easily arbitraged away by market participants.

The simplistic view – Long Volatility

One idea of using volatility to your advantage is astonishingly widespread and appears in the financial media with regularity when things are calm – despite it being fairly obvious that it would be extremely difficult to use as a profitable strategy. There always seem to be some “big traders“ that are betting on a new VIX spike as soon as the last one subsided – it is not a fallacy only ignorant small traders fall prey to.

Traders observe gradually declining volatility after one of its regular spikes and smell opportunity on the long side when VIX hits a point where it regularly bottoms out (volatility has a natural lower boundary where the market doesn’t get any calmer). At the moment this often happens when VIX trades around 13: The downside is capped (the 2017 all-time lows, 3-4 points below, are rarely reached) and the upside is huge (several 8-12 point spikes up happened in the last 6 months alone).

Who wouldn’t take this trade – it is virtually free money lying in the street, isn’t it? On top of that, the trade is negatively correlated to an equity portfolio and it makes money when stocks lose – isn’t that just too good to be true?

Exactly – if only things were this easy! But here is the headwind this overly simplistic strategy faces:

VXX (a long VIX Futures ETP charted here over its 10 year history using data from finance.yahoo.com) would take a rare genius to make money in timing its upward moves, but this is exactly what the simplistic trader is trying to achieve.

You are looking at a logarithmic chart: going through several inverse splits VXX fell from $100690 to $19,79 over 10 years – this WeWork-like burn rate is certainly far from a no-brainer long opportunity!

Why is that the case, when all seemed so easy?

Below the surface the mechanics of the VIX Futures market are responsible. The magic word is contango, which sneakily prices in the crash risk and the desire to hedge that I mentioned above.

VIX itself cannot be traded and tradable VIX Futures (which all VIX ETP are based on) expire each month. Most of the time VIX Futures are significantly more expensive the longer they have until expiration (a constellation called contango in the futures markets) and – all other things staying equal – they will continuously lose money as they converge towards the actual VIX price on the day they expire. Between the first two expiration months that loss is about 4% to 5% (each month!) on average – at the moment November to December 2019 contango is up to just under 10%.

VIX Term Structure on October 27th 2019 via vixcentral.com

That makes the wait for that VIX spike, that is certain to appear sooner or later, a very expensive proposition.

Especially considering a characteristic of stock market volatility, that has been observed since the 1960s: volatility tends to cluster and often hovers at its lower boundary for long periods of time.

Of course, not everyone betting on rising volatility is a fool. Many sophisticated institutional players and hedge funds use such bets as a hedge for an equity-heavy portfolio to neutralize some of its inherent short volatility exposure, but they knowingly and willingly pay a premium for this crash protection. Several funds even specialize in reducing this insurance premium as much as possible with complex strategies as demand for protection understandably is very high.

The long volatility reasoning does contain some kernels of truth: whenever the VIX Term Structure inverts, the roll yield becomes positive for long volatility positions and they have a much better chance to be profitable – especially in bear market environments when the inversion is more likely to be sustained for some time and the headwind turns into a tailwind. A long volatility strategy could be constructed successfully, if it specifically targets bear market regimes.

Also, VIX spikes from prolonged low levels can be vicious and are often triggered by fairly innocent drops in the underlying equity markets. We have to be aware of this invisible coiled spring building up when we go down the road to take the other side of the simplistic trade:

If the VXX chart above does not contain a great opportunity on the short side, I do not know what does.

Second level volatility trading – Short Volatility

Trading volatility on the short side regularly gets a bad rap, especially whenever we witness another overextended short vol hedge fund blow up or a „volmageddon“ event happens. Traders have to always be aware that this is the reality of short volatility trading: a large part of its high return expectation is risk based, which means that the risk materializes every once in a while as a severe loss. A short volatility strategy simply cannot be traded successfully without taking this fact into account.

What makes this difficult in real life is the very specific return distribution of short volatilty strategies. It is similar to the return distribution of equity markets, just much more extreme.

The returns of short volatility strategies are highly negatively skewed, which means that they are especially prone to crash risk and will lose the most, when things are already bad.

Convergent, negative skew strategies are usually based on mean-reversion where many small gains are interspersed by few, but large losses. Being short volatility creates reliable income in normal markets with sideways and regular up- and down-moves, it will underperform in strong up-trends and crash in strong down-trends, when volatility tends to shoot up – there needs to be a strict mechanism in place to exit the strategy, when volatility spikes, as well as diligent position sizing. The crash risk can stay hidden for years lulling investors into a false sense of security.

Things can sail along very smoothly and profitably for long periods of time – a siren call enticing traders to over-extend themselves, only to give back a lot of these profits in a very short period of time or even blow up their trading account, when volatility suddenly spikes.

Short volatility as the default positioning

Because the volatility risk premium is quite persistent in equity markets, a basic short volatility exposure could be considered our default (and in fact it is, by implication, in the equity exposure that is part of most portfolios).

Two simple filters, that tell us when not to be short volatility, can shift probabilities in our favor by avoiding times when crash risks become elevated – (not so) coincidentally they also work quite well to avoid large drawdowns in the stock market:

- Only hold short volatility positions when their main reason for being profitable is present – the VIX Futures Term Structure is in contango. As an actual trading signal using a threshold at a slightly negative contango (around -1% to -2%) can avoid whipsaws when the term structure flattens temporarily.

- Only hold short volatility positions when the S&P 500 is in a long-term uptrend. A majority of volatility spikes and prolonged backwardation (the opposite of contango) periods occur when equities are already trending down.

The short volatility ETF SVXY (red) serves as an example of a generic buy-and-hold short volatility strategy: It outperforms the S&P 500 (black) over long periods of time, but is prone to hidden crash risks which lead to similar returns over the long run. A simple strategy (blue), that only invests in SVXY when the VIX Term Structure is in contango (> -1,5%) and the S&P 500 in a long-term uptrend (above its 275-day moving average), manages to capture most of the upside while avoiding the worst crashes – leading to a considerable outperformance over the S&P 500 at an elevated level of volatility.

A generic strategy as in the chart (in blue) above can work quite well using short volatility ETF, shorting VIX Futures or selling VIX Futures / VIX long ETP call options.

But, because it relies on exit signals as protection from volatility spikes and these instruments often contain unlimited risk, it stays vulnerable to extremely sudden crashes that fail to be signaled in advance – this may lead to large losses that are very difficult to recover from. An obvious example is that short volatility funds SVXY and XIV lost virtually their entire value over the course of just one day in February 2018.

I used such open-risk methods successfully for several years myself, luckily avoiding events like volmageddon 2018 that were signaled in advance – but luck will eventually run out (fortunately I wised up before that happened).

The best way, I found, to maintain a constant short volatility exposure whenever contango is present, is shorting VIX Futures outright, laddered across expirations dates. Over time these futures become cheaper as they roll down the curve towards VIX spot price (as long as it does not spike in the meantime) and positions further out in expiration are much less vulnerable to VIX spikes (the closer to spot the more VIX Futures participate in the spike). Unconstrained risk still remains however, even if it is lowered considerably, and margin requirements can be fairly steep.

If we ratchet our expected return down a notch, in exchange for certain protection against such rare tail events, we enter the next level of short volatility trading: we can be in complete control of our risk while we still participate in one of the most pronounced risk premia out there.

Here another analogy from the insurance industry fits very well: while we insure other market participants against regular crash risk for a premium (a profitable endeavor as the market over-estimates these risks on average), we in turn re-insure ourselves against the rare, extreme crashes, that could potentially destroy our portfolio.

Third level volatility trading – Re-insured Short Volatility

There are several ways to construct a short volatility position that pays a return-reducing premium in exchange for controlling the risk of extreme tail events.

As options are the best instruments to achieve this we run into an additional problem: accurate historical data is hard to come by as many of these options rarely trade and spreads vary widely during the course of the day. I rely on three years of my own actual trading data to judge that the examples below are realistic (not cherry picked) and – as they align with backtested results over diverse instruments – I use statistics from my own trades as a basis to calculate return expectations.

One rule of thumb is quite important in practice: always use limit orders placed in the middle of the wide bid-ask spread when placing a trade – they will usually get filled, if you are patient.

The nitty-gritty details

Bear call spreads on either VIX Futures or long VIX ETP (VXX or UVXY) are a popular method for controlling risk while shorting volatility.

By entering two call option positions at the same time, one long and one short, at different strike prices but with the same expiration date, the risk is limited to the difference between the two strikes minus the premium received. One sells a call position at the money (ATM) and buys one of equal size with a strike a couple of dollars higher.

UVXY (a 1,5x long VIX Futures ETP) one month call options ladder 10/30/2019 at Yahoo! finance

For example, a bear call spread with one month to expiration, selling the ATM $20 strike for $2,08 while buying the $24 strike for $1 will net $108 ((2,08 – 1) x 10) in premium with a maximum risk of $292 ((24 – 20) x 10 -108) and a margin requirement of $96 (at my broker).

This may seem like a low reward : risk ratio, but contango roll yield makes this a high probability trade which is actually pretty good as it will earn the premium over 80% of the time when implementing the simple rules above (81,72% in my actual trading stats covering the last three years. This would result in positive expectancy of an average win of $34,58 per trade or $31,58 including trading costs – which equals an average profit of 33% on margin).

Because of the wide bid-ask spread many of these options have, I find these combined positions a bit cumbersome to handle – often limit orders for a call spread are less likely to be filled at an advantageous price than a single option contract. Also transaction costs double which has quite a big impact in practical trading and position sizes are harder to calculate.

Buying put options instead would definitely be the easier path to take and using UVXY (or VXX) put options has become my preferred method recently, because it is very straightforward to integrate this in the day-to-day management of my portfolio (see the end of this post).

But let’s have a closer look whether doing this has any downside in practical implementation (as buying options often has):

With the market being as smart as it is, the costs of UVXY / VXX put options take into account the current volatility environment, contango and even anticipated VIX behavior – they represent the notion of a re-insurance premium and it is quite steep at around 25% of the UVXY price for 5-month ATM options (or even higher).

Does the high premium destroy the opportunity?

To get a better feel of how the different factors weigh into option prices, here are some recent examples of UVXY put options that are about 5 months from expiration (4 – 6 months is my sweet spot even, if I only plan to hold the option for a couple of weeks as I can tolerate some time of adverse movement before premium deterioration accelerates in the last two months of its life – the majority of VIX spikes prove to be temporary even if it sometimes takes more time than anticipated to play out):

Put prices are especially high when VIX spikes (as in August): with VIX @18; $7,50 – $8 or VIX @20 $8,50 – $9 for the ATM options with UVXY trading around 30 to 33.

This elevated premium of up to 30% – UVXY would need to fall by 8 or 9 dollars over 5 months before the option even becomes profitable – prices in the mean-reversion tendency of VIX (it is likely to fall after a spike) as well as the effects of contango.

To accurately forecast both factors is difficult, but history shows that UVXY is regularly cut in half over 5 months in such conditions (in fact it already trades below $20 currently).

Buying VXX/UVXY puts into VIX spikes is not as advantageous at it would seem at first glance – VIX mean-reversion is largely priced in.

Put premia fall when VIX nears it lower boundary (below 13): on 25th Oct 2019, with VIX around 13, we pay $5 for the ATM option with UVXY at 19,50. The option now has increasingly become a pure play on contango roll-yield which makes it much easier to model:

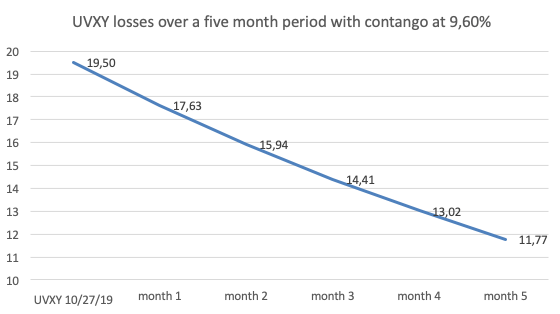

We can make a quick back-of-the-envelope calculation that simply assumes volatility will stay unchanged (which is actually the most likely place we will see future volatility at, because it tends to cluster around its lower boundary):

On 25th Oct 2019 we have the following variables: UVXY $19,5; 5-month ATM put option $5; contango 9,6%.

As it loses about 9,6% per month through the negative roll yield (UVXY continually sells the cheap 1st month and buys the expensive 2nd month VIX Future and can actually be expected to lose more, because it is a 1,5x leveraged product) we can expect UVXY to go down to $11,77 by the put´s March expiration assuming a static volatility environment. A loss of $7,73 from today´s price. Subtract the premium paid ($7,73 – $5) and we can expect the put option to earn $2,73 by expiration – a nice profit of 54% including transaction costs.

In practice we do not have to wait until expiration, if we aim for a profit target between 30% and 40% (which will often be reached around 1 to 3 months into the trade). This has the advantage, that we run into less of a chance to give back our profit in the next VIX spike as well as avoiding the last two months in the life of the option, when premium deterioration accelerates – and we still pocket a majority of the profit.

Overall UVXY put options deliver positive carry as the negative carry cost of the premium is more than overcome by the positive roll yield earned from contango as UVXY rolls down the VIX Futures curve – they make money when the volatility environment doesn’t change.

In fact risk-adjusted returns are roughly equal to the call spread discussed above as should be expected.

This is very unusual and presents a great opportunity as most option premia, e.g. for options on stocks, prove to be a drag on returns (this is the reason why most long option trades are a suckers game as they have a hard time overcoming this headwind over the long run).

Risk can be controlled exactly as losses can never be higher than the premium paid – with good strategy statistics it is easy to size positions optimally.

Whether using long puts or bear call spreads is a matter of personal preference as there are some relevant differences in the day-to-day behavior:

- Call spreads can be expected to turn a profit more frequently and profit even if UVXY trades unchanged at expiration. In return profits are capped at the premium received and margin requirements can change significantly during the course of the trade. They are a pure-play carry trade.

- Puts need UVXY prices to fall considerably for a positive return, but have uncapped profit potential. Important to me is the fact that it is easier to sit through some adverse movement as no additional margin is ever required (Put premia have to be paid in cash and can’t be traded on margin at my broker), also buying options is less restricted than selling them. You can expect to pay up for this ease of usage as option prices are demand driven (long puts will cost a little more while short calls will pay a slightly elevated premium).

Position Sizing

One of the most important subjects in trading in general is especially important in this context as large losses tend to be relatively rare and steep for short volatility strategies.

If you have reliable strategy statistics, my favorite method for optimizing positions for the greatest possible return while avoiding ruin, is the Kelly Criterion (or optimal F). I go for half or 1/4 Kelly to avoid extreme volatility and I use statistics from the generic, simple strategy outlined above (even if I think I can improve on those) to stay robust.

Over time these results have shown to be realistic in actual trading: UVXY Put profits arrive at my initial profit target of 30% on average 80% of the time and I expect to lose between 50% to 100% of the premium I paid in about 20% of my trades for an average loss of 75%.

Plugged into the Kelly formula (in Excel: =((avrg profit/avrg loss)*win prob-(1-win prob))/(avrg profit/avrg loss) ) we get:

This means that, for a standalone strategy using 1/4 Kelly, I would buy UVXY puts for 7,5% of my trading capital; for bear call spreads that percentage should equal the maximum risk taken (not the premium earned!).

The long-term return expectation here is about 9% per trade (which is similar to the 33% on margin for the call spread on risk-adjusted terms, where I would earn $31,58 for $292 at risk or 10,8% per trade, but we can see that we paid an extra fee for the puts as expected).

In the implementation of these strategies I hope to add some additional value – especially by avoiding a couple of big losses over time. To do this I have found ways to integrate them into my overall portfolio that is specifically suited to my investment process, preferences and personality.

Portfolio Integration

For me, currently the best way to use the properties of UVXY put options is to align them with the long-term market uptrend during short-term (1-8 week) swings, taking additional advantage of the mean-reversion tendencies of stock markets around 1-month time periods. More details can be found through the links to different articles on my blog.

To do this, I first use a long-term analysis to decide whether to use such risky strategies in the current market environment or not. I describe this „Meta Strategy“ in several articles. In a favorable environment I divide my portfolio into a long-term tactical ETF portfolio and an alternative strategy sleeve.

The alternative sleeve (hedging and short volatility strategies) continuously adjusts portfolio exposure over short-term market swings by using a bayesian process to map the different probabilities for future market directions integrating different assessments over long-, medium- and short-term time frames. At times that leads to stacked risks at full Kelly levels, while at others risk is hedged out to near zero over the course of 1-2 month cycles.

In addition I´m also cognizant of a few other factors that are hard to quantify. For example, that risks are like an invisible spring coiling tighter and tighter the longer VIX hovers near its lower boundaries.

A telltale sign is a rising VIX coinciding with a rising S&P 500 – this was visible in January 2018 and also leading into the market top before the financial crisis.

Thank you for reading and good luck with your trading!

David

You can follow how I invest according to the Meta Strategy in my own portfolio by subscribing to my monthly newsletter here – it includes a defensive and an aggressive ETF model portfolio with all the ticker symbols and other details for US as well as EU investors.

Hi David,

I just wanted to say thank you for sharing this instructive post. Very well explained. Myself, I am using similar strategies to the ones you describe, trying to take advantage of the same edge. One is buying UVXY put strike 20 and very far away (1 year or more). And the second one is buying VIX put strike 20 dated for 6-8 months. I’ve never tried bear calls for the reasons you mention: if VIX and UVXY spikes, margin requirements can change or maybe you cannot close your trade due to market halt, lack of liquidity, etc. Moreover, UVXY has had several contrasplits in the last years, and you might end up with option contracts of the ‘old’ UVXY.

I wish you the best luck in your trades.

Regards,

Curro

Thanks Curro, yes you are quite right. Especially the changing margin requirements get a lot of traders into trouble right now…

all the best

David

Hi David,

I just wanted to say thank you for sharing this instructive post. Very well explained. Myself, I am using similar strategies to the ones you describe, trying to take advantage of the same edge. One is buying UVXY puts strike 20 and very far away (1 year or more). And the second one is buying VIX put strike 20 dated for 6-8 months. I’ve never tried bear calls for the reasons you mention: if VIX and UVXY spikes, margin requirements can change or maybe you cannot close your trade due to market halt, lack of liquidity, etc. Moreover, UVXY has had several contrasplits in the last years, and you might end up with option contracts of the ‘old’ UVXY.

I wish you the best luck in your trades.

Regards,

Curro